Retirement Financial Planning:

The Beck Bode Guide

Table of Contents

- Chapter 1: Why Retirement Planning is Important

- Chapter 2: How Do I Know When I Can Retire? How Much Money Do I Need to Save?

- Chapter 3: What’s the Best Way to Invest for Retirement?

- Chapter 4: How Do I Get Started With a Personalized Retirement Plan?

- Chapter 5: Why Should I Work With a (Fee-Only) Financial Advisor?

How to Plan for Retirement

Ask people whether they are prepared for retirement, and you’ll be met with a range of responses. Many young people consider it a topic reserved for older folks, and tend to avoid thinking about retirement, as though it were something that while real, doesn’t really apply to them. Better suited for their parents. Speak to those “older folks” – perhaps still working, or approaching what is considered traditional retirement age, say their sixties, and again you will encounter another set of responses. Many people who are near or at retirement worry about not having enough or running out of money. Almost everyone wishes they’d started saving sooner. Others question whether they were/are saving in the right places. The emotions around retirement planning cover the spectrum from denial to anxiety to indifference to excitement (with that last category representing a minority, we have discovered). People may be excited to stop working, but they’re not always excited about the state of their finances at that stage in their life.

We decided to write this article to address many of the questions people have about retirement planning. Regardless of where you find yourself in terms of life stage and where you are in your retirement planning journey, we hope you can find some valuable information here.

Why Wealth Management Is About So Much More Than Retirement

What if I told you to stop thinking about a retirement date when considering your personal financial plan? What if I told you that investing isn’t just about retiring and living happily ever after?

You may be wondering, “Why should I even plan? What's the whole point?” This is a great place to start.

According to the American Psychiatric Association, over 70% of adults worry about money. This results in stress, prolonged exposure to which can lead to physical ailments such as heart disease, migraine headaches, and poor sleep.

If worrying about money causes stress, then would the opposite not also be true? Not having to worry about money frees you up to do other things with your mental and physical energy, not to mention that eliminating financial stress will hopefully add years to your life, rather than subtract from it. Also, you should know that the number two reason for divorce is money (the number one reason is infidelity). Having a plan for your finances can also save your marriage.

In the Wizard of Oz, the yellow brick road leads to Oz. Think about retirement planning as though you’re creating your own yellow brick road, your own path to success. That’s what a retirement plan is designed to do. It’s taking everything we know right now about your life: your goals, hopes and dreams but also the risks you face, the income you generate and all the other realities of your financial picture. You take all these data points and with the help of a knowledgeable guide, and an experienced financial advisor, put together a step-by-step path to getting to your destination. Obviously, as time goes by, things will change. Your plan will need to be adjusted accordingly so that despite all the twists and turns, you still continue in the right direction.

Having a destination and a roadmap, even if it’s a changing roadmap, truly increases your probability of success. We know from experience that no one ever reaches their destination in a straight line, but we also know that most people who try to “wing it” rarely, if ever, reach their destination.

When people think about financial planning, their mind often goes straight to retirement. While retirement is a centerpiece of a financial plan for most clients, it’s not its exclusive focus. The good thing about having a retirement plan is that you can factor the rest of your life around it. I’ll give you a real example from my own life. My wife and I wanted to buy a vacation home, but we had to think about how this investment would affect our lives, not only over the next few years, but for some time to come. We have kids we want to put through school. We have retirement plans for ourselves. We also want to travel as a family. The first thing we did as we considered this potential second home was to plug it into our plan to see how this new commitment might affect our financial future.

If you are one of those people who gets their financial education from the media (first of all, we hope you don’t, but if you do…), you may be familiar with their focus on two questions: “When can you retire?” and “How much do you need?” Retirement planning is about scenario planning with real-life decisions. It allows you to think through how financial decisions today may affect your financial future, whatever your goals may be. Our clients come to us with all kinds of questions about their retirement plans, questions that at first glance have nothing to do with retirement. Unexamined, these decisions they are weighing will have an impact on their retirement plans, too, of course. People ask us about buying second homes or boats, about being able to afford their kids’ college tuition, and sometimes they may even ask if we think they can afford to have a third, fourth, or fifth child! How would that impact your retirement?

The trouble with the terms “financial planning” and “retirement planning” is that they are inaccessible to most people. We wish there were a more exciting way to name this critical exercise of looking at all the amazing things you want to do with your life, and figuring out a plan to make them happen! Some people are turned off by the idea of planning, because they think they aren’t old enough, don’t have enough money, or it’s so far down the road, they don’t think they need it. What we want to scream at the top of our lungs is that retirement planning is not just as you approach retirement. The younger you are when you start doing this, the more successful you will be in getting to your goal. The chances of you making better financial decisions increase dramatically the sooner you engage in this process. Maybe they should call it “success planning.”

This is the question everyone wants answered. As a financial advisor, I am obligated to ask you a question in return. That question is, “What kind of retirement do you want?” And by that, I mean, how do you want to live in your retirement? I keep on seeing articles about people who claim they retired at age 40 with a million in the bank. All I can think of is, that’s great, but how in the world are they going to live off forty thousand dollars a year (the approximate amount of income they can conservatively produce from their savings without touching their principal). Plus, they must get insurance, and things keep costing more every year, and, and, and…

I don’t know about you, but that’s not the lifestyle I want. In any event, the question is, “what is the lifestyle YOU want?” Usually, you’ll look at the lifestyle you are leading now, since we know (or can quickly figure out) how much that’s costing. Do you want to continue your current lifestyle, or change it in any way? How much money will you want to spend on an annual basis? Will you want to travel? Will you want to contribute to a cause or charitable organization? You really need to have a sense of how you will want to spend your retirement.

Now you will need to tell me how soon you want to be living this way. Any capable financial planner will be able to tell you how much money you’ll need the moment you retire, and how much you’ll need to save over how many years to get there. From that standpoint, it’s simple. Math is not the difficult part. The hard part is figuring out how you want to live. If you are already saving, or have some money in the bank, that too, is factored into the calculation. And of course, there’s always the issue of not knowing how long you will live, so we must make some assumptions there, too.

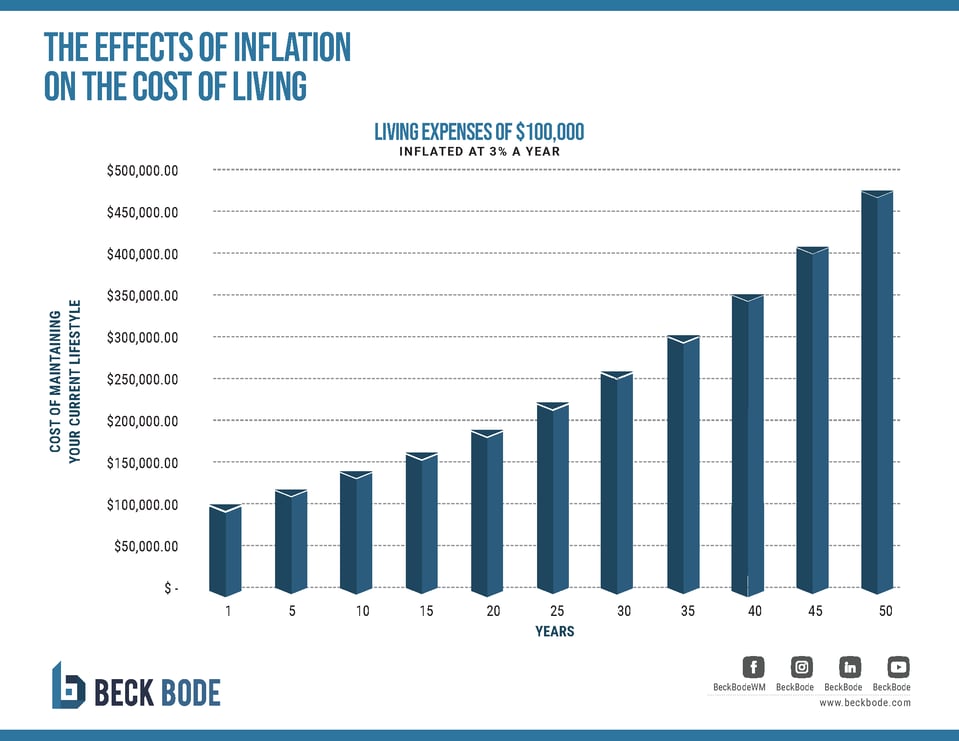

Every financial plan has living expenses going up at a certain percentage, typically around 3% a year. That’s an assumption that can be adjusted in whatever software it is that is used for modeling your scenario. Let’s just assume your annual living expenses today come to $100,000. If expenses were to increase at 3% a year, for the next 30 years, do you have any idea how much it would cost to live your lifestyle? It’s a mindboggling $250,000 (approximately). Wow!

Inflation

One of the biggest things that people disregard, or don’t take seriously when they are planning for retirement is inflation. You must factor in inflation; it is the silent killer of all financial plans. Inflation is a reality because we all know things increase in price over time. A solid retirement plan has to face those rising costs, especially because the average retiree, provided they’re in decent health, could be in retirement for three decades or more! That’s thirty years that your investments need to keep up with ongoing inflation, not to mention your committed financial needs. Your investment portfolio needs to be specifically designed to outpace inflation so that you can avoid the disaster of eroding buying power over time.

Lastly, a solid retirement plan must be built to withstand surprises that are simply a part of life. How you handle the curveballs that life throws you dictates how they will affect your financial future. The things that could affect your plan could be a change in income (either through the loss of a job, or perhaps an increase in revenue). Other financial changes could be death, long-term illness or the need for long-term care, divorce, the birth of a child. All these things have a potential financial impact. One of the most frequent questions we get is when people want to leave their current job, and they want to know what the lowest amount of income is they need to generate without jeopardizing their retirement.

We can use financial planning software to model these scenarios and provide answers that can help with our clients’ decision-making.

Where to invest?

There are so many ways to invest! People may say, “I'm putting money into my 401(k),” and think that they’ve now taken care of their entire financial future. Well, what does that even mean, putting money into your 401(k)? If you were trying to save a down payment to buy a house, would it make sense to put that money into the 401(k) bucket? Thinking that saving alone will help you reach your destination once again limits your options. Saving is good. Saving in the right places is great. Saving the right way in the right places is the best of all.

The confusion begins with the many choices investors face, along with a lack of education regarding the consequences of those choices. Before you even put a single dollar away, you should consider what it is that you’re saving for. This is why it is critical to have a financial plan, or a retirement plan, whatever you want to call the roadmap that leads you from where you are today to what you want to accomplish. Things like 401(k)s, Roth and traditional IRAs, even some insurance products, are investment vehicles. At Beck Bode, we believe that every investment vehicle needs to have a plan behind it. Think of it like a car – the investment vehicle are the wheels under you, and the financial plan is the map you’ll follow to get to your destination.

Which investment vehicle is right for your goal? Well, let’s start there. There are two things that you need to consider as you evaluate the right investment vehicle for your particular need. The first is efficiency, the second is flexibility. In finance, efficiency may be defined as “the peak level of performance that uses the least amount of inputs to achieve the highest amount of output.” That means no waste! When I think about waste, I think about all the ways you could be losing out on output and the biggest thing that comes to mind is taxes. You must look at the tax efficiency of your vehicle from the very start. Because every retirement investment vehicle will address taxes in one of two ways: you will either put in after-tax money, which will grow tax-free and come out tax-free, or you will put in before-tax money, which will grow tax-deferred, but will be taxable upon withdrawal. Flexibility refers to the ability to access your money. Some retirement investment vehicles, like 401(k)s and IRAs are designed to keep you invested until you reach at least 59 and a half years of age. You could withdraw sooner than that, but you will face penalties.

Roth vs. Traditional?

This is a big question for many people: should you put their money into a Roth account or a traditional IRA (or traditional 401(k))? The answer comes down to your belief on taxes. Are you going to pay taxes today, or will you pay the taxes down the road? Depending on the current client's tax situation, their current tax liabilities, and how they feel about future income taxes based on their earnings, the longer they have until retirement, we tend to recommend that they pay the taxes on their investments sooner rather than later. For those folks, we would most likely recommend a Roth. That way we know your money goes in after-tax, grows tax-free and comes out tax-free. Some people ask, “Where do you think tax rates are headed?” I have no idea! I will tell you that if you invest a hundred thousand dollars today and over the course of some decades it ends up being a million dollars and you want to withdraw that money, you will be paying taxes on a million dollars. A lot goes into understanding our client’s goals, their time horizon, and their tax situation. Mathematically, it makes more sense to pay your taxes upfront, rather than after the money has grown significantly.

But let’s say you could use a tax break today. You’re in a high tax bracket right now, and you expect you’ll be in a lower tax bracket in the future. Clients may say they can't afford to put after tax money into their investment vehicle because of other things going on in their lives. They may really need tax deferral right now. In that case, they take the traditional approach: they put pre-tax dollars into a traditional IRA or a traditional 401(k).

Contributing to your 401(k)

If you have a 401(k) you must come to terms with the fact that the investment choices within it are designed for the masses. This means that you have limited flexibility. The only thing you control is your allocation within the 401(k). Think about it, if you’re working for a company that offers a 401(k), this vehicle needs to be able to meet the needs of the 22-year-old who just started their career, as well as the 60-year-old who is going to retire pretty soon. So you really can’t get very specific with your investments. You get to pick from the limited options. People ask, “how should I invest in my 401(k)?” Well, how is your 401(k) different from anywhere else you invest (other than you don’t have many choices)? Since your 401(k) is part of your net worth, you need to invest it according to your risk tolerance, just like you would the rest of your assets.

Once again we come back to taxes. Why are you investing using a 401(k) in the first place? Well, because for most employees (let’s leave out business owners for now because there are additional vehicles available to them), the 401(k) is the number one place where a significant amount of pre-tax money can be saved. You can save more in a 401(k) than in an IRA. You save in a 401(k) to save money, but also to reduce your taxable income.

Matching and more…

Most good employers also offer matching inside the 401(k) up to a certain amount. This means that up to a limit, your employer may match a certain percentage of your contributions. This is free money! Take it! Finally, if you work for a publicly-traded company, you potentially could purchase stock at a discount inside of your 401k, which is a huge benefit for employees. All in all, we would say, if you can max out your 401(k), do it.

Age-based and target-date funds

In recent years there’s been a growing trend of age-based retirement funds, where people basically pick a target-date fund that lines up with approximately when they think they may retire, and the investment company basically adjusts the volatility exposure of the fund (to more conservative) as the fund gets closer to that target date.

We think that this is one of the worst “innovations” that have been created for investors, and that these target funds are potentially detrimental to investors’ financial health. On the surface, it looks easy and convenient. You don’t even have to look too deep to realize that these funds do not effectively align with an investor’s individual financial picture. They make you think that it simplifies your life, and that you don’t have to think about your investments anymore. But the truth is that these investments are not working for most people, but they don’t even know that it’s not working because most people have adopted a ‘set it and forget it’ approach to their retirement funds and have most likely forgotten to look and see what’s really going on.

Brokerage accounts

When people ask about opening brokerage accounts, of course, we always ask why? Brokerage accounts are funded with after-tax dollars, so if a person is interested in opening up a brokerage account, we always ask whether they are maxing out their 401(k). Next, of course, is the reason for funding the account. Because the nature of brokerage accounts is that because they are funded with after-tax dollars, they have the ultimate flexibility. You can put in as much money as you want, and you can invest in literally anything you want. Some factors you need to consider when you decide to open a brokerage account are how long before you want to access the money, and how you feel about volatility. mention not investing money that you will need in the short term. We do not recommend people open brokerage accounts if the funds are needed in the short term for large purposes in the near future.

Diversification

A word about diversification – because we write at length about diversification and if you are interested in hearing our position on it, we urge you to read the many blogs we have written on the topic. At Beck Bode, our viewpoint on diversification is significantly different from conventional firms. Traditional firms will advise you to diversify your portfolio, by which they mean that by mixing asset types within a given portfolio, you can manage your exposure to risk.

At Beck Bode, we have a distinctly different view on the matter. We believe that people live much longer than they think they will, and at least one (if not both parties) in a retirement-aged couple will have two to three decades in retirement. Conventional wisdom would have this retirement-aged couple scale back to more ‘conservative’ holdings (including bonds), to minimize their exposure to volatility. At Beck Bode, we know that thirty years is a long time to be putting your money on the back burner, especially given the reality that inflation is the biggest threat to your retirement funds lasting.

All to say that at our firms, we advise our clients to stay “diversified” – not by taking on every asset class under the sun, but by holding a concentrated portfolio of carefully selected stocks using our fully transparent investment Strategies, knowing that if we have a disciplined method (which we do) of what to buy, when to sell, and what to do with the proceeds, we can stay in the market for the long term and reap the premium that the market produces over extended periods of time. This proven strategy has helped many of our retiree clients produce healthy retirement streams well into their 60’s, 70’s, 80’s and beyond.

How To Diversify Your Portfolio: It’s Not What You Think

Every day people come to us with a stack of statements from wherever they’re investing, whether it’s a no-load fund, or a large wirehouse or some other wealth management firm.

BLOGTax-deferred annuities

Before we go into tax-deferred annuities, I must tell you that the world is divided on this topic. People either love them or hate them. Our view on these investment vehicles is that 99% of the time, they are unsuitable for clients. To be fair, we should look at the good and the bad. Let’s just get the good out of the way, first. The good thing about annuities is that they provide a stream of income, and keep you invested in the market. If you’re looking for guarantees, of which there are very few in life, then annuities provide the highest guaranteed lifetime income. That’s it.

But everything comes at a price, right? Especially guarantees! This is where the controversy comes in. Annuities have expense ratios that are rarely truly understood. Both buyers and sellers of annuities can get lost in the details and the rules. And if you break the rules, there are consequences.

Without getting into the details, the costs are high because annuities have a feature that is reminiscent of life insurance – if you die there is a death benefit. There are also living benefits, designed to pay you an income stream while you are still living. But who’s paying who? You give the company an initial investment, and they give it back to you over a 15- or 20- or 30-year period. At the end of the day, the costs associated with the annuity are a result of the insurance you are buying on your investment, so that the company can give you your own money back. The company gives you rules to follow because they don’t want to take on unnecessary risk. The people who generally buy annuities also fit that profile because they, too, don’t want to take on too much risk.

The very small minority of people for whom this makes sense are folks who need all these guarantees, and who don’t trust themselves to stay invested in the market, or to take regular distributions on their own money.

Real Estate

Next up is real estate. Real estate is a wonderful way to invest in the market, and like everything else, it has its upsides and downsides. You may think you can nab a fixer-upper, maybe a multi-family, and clean it up and rent it so that you can cover the bank loan (if it’s financed) and then as it appreciates over time, you are building yourself a nice little nest egg. That’s the idea, at least. For many people, this works out. I have yet to meet someone for whom this works out without any bumps and glitches. Two factors you must consider are that renters put on quite a bit of wear and tear on a property, so you have to be prepared to repair things (which you’ll either need to do yourself, if you can, or outsource to professionals). The second issue is that you may have times when the property is not occupied – in between renters, or while you are doing repairs. That’s when the property is not generating any income for you. You’ll need to build a cash reserve to make it through lean times, or to have liquidity for larger repairs. When things break and you need to tend to them, if you do it yourself, then you are giving up time that you may have been spending at a paying job, or with your family. And if you don’t want the hassle of fixing broken toilets and leaky roofs, you’ll need to hire a property management company. All to say that there are real costs associated with the dream of owning real estate. As a means of funding one’s retirement in most cases, you will need multiple units for it to make sense.

When to take Social Security benefits

Now that we have looked at all the different ways you could be saving for retirement, it’s time to address the question of Social Security benefits. Social Security was instituted in 1935, and originally was envisioned to help older Americans by providing an extended income as they came into retirement age. It is funded by a payroll tax which workers pay into as they earn income. There’s been plenty of debate over the years as to whether Social Security will be around in the future, and at what point it will “run out of money.” Again, we don’t know, but for all the years that this debate has been ongoing, Social Security is still around. Assuming that it still continues, most clients want to know when the best time is to take Social Security benefits.

The short answer to this question is that the longer you can defer taking Social Security benefits, the better it is. The benefit increases with your age. This is the rational approach. This said, most clients are quite emotional about taking the Social Security benefits. After decades of working and paying into the system, they are anxious to receive their benefits. They don’t care about the math – they want their money now when they are young, healthy and able to enjoy it.

We tell people that Social Security cannot be the backbone of their retirement plan. Can it be part of the retirement funding picture? Of course, it can, and it should. Social Security is designed to be a piece of your retirement income stream guaranteed by the US government with an inflation hedge pre-built into it, which we like to help with rising costs of everything in life.

Goals

We can’t stress this enough. The best retirement strategy starts with proper goal-setting. Even if you’re young and retirement is at best hazy, it helps to have a sense of where you are headed, loosely. As the years go by, you will be able to continually refine your vision.

Tax considerations should play a big role in the investment decisions you make toward your financial future. Work with an experienced financial advisor who understands the tax implications of the various vehicles that are available to you.

Lastly, remember to start with a plan. Anyone who has an income needs to have a financial plan. Your portfolio needs to power your financial plan.

Retirement planning is no different from any other kind of planning, if you set out to build a house, or bake a cake, or go on a trip: you need an end goal. The difference being that when it comes to retirement, we are talking about a point in time in the future, and a picture of how you would like to live when you reach that point.

We begin with: what do you want out of your life? As daunting as it may be, this is the real question. Unfortunately, no one can answer this question for you. What we can do is give you a sense for the kinds of interactions we have with our clients, and what we have witnessed over decades of helping people plan for their financial future.

People come to their planning meetings armed with all their documents, their financial statements, and all the paperwork they have prepared to talk about their money. We ask them to set aside their papers. Yes, we will review them, but there is another exercise that comes first. We ask people to close their eyes and imagine what they want to get out of their lives, without any limitations. If there were no barriers to achievement, what would they do? If we are working with a couple, we ask them to not look at each other. Each person gets to speak their dreams without a need for the other’s approval. The only requirement for this exercise is that it will take money to achieve this goal.

To begin with, it is amazing how often partners are hearing each other’s deepest wishes for the first time!! Clearly, most people do not communicate well with each other, especially on the topic of money. Our job is to gather what comes out of this exercise and to start working with it. The financial expense associated with those dreams becomes a starting point for us. We can model into the future, given what we know about how much the dream costs, how much money the client has at hand, and how much capacity they have to save for the future. With this information, we can go back and offer a reality check as to what’s possible in the timeframe they are considering. This is a healthy exercise for anyone to go through. Most people who save, do so without a concrete goal in mind. Then they retire and have no idea what to do with themselves when they could be enjoying their life to the fullest.

Every saving plan needs to have a corresponding spending plan. Otherwise, you get to retire and then realize that five or ten years ago, you should have done this, that or the other. By speaking your wishes ahead of time, we have a defined destination to work with, and can assess where we are relative to reaching it. Another thing we hear frequently from folks is that they want to leave money for their kids or grandchildren, until we ask them if they would like their beneficiaries to enjoy the funds during their lifetime, or after they are long gone. Not one person has said they want their beneficiaries to enjoy the funds when they are no longer alive. Giving is for the living! This exercise of imagining the future brings up a lot of emotion for people, because it allows people to think about the impact their money can have on others. That’s why it makes sense to have a plan.

To summarize this all, the way to get started with a retirement plan is to think about the life you want to live, what kind of impact you want to have, and then to identify a capable and experienced financial advisor who can take you through a systematic process to achieve your goals.

There's some confusion about what constitutes a financial advisor. Even though ours is a regulated industry, many people can call themselves a financial advisor. Your financial advisor may be an insurance agent, or someone who only offers investments. Or maybe you have a financial planner who just plans and then you need to implement the plan using other vendors and professionals.

Our recommendation is to start with education. If you are in the market for someone to help you with a retirement plan or a financial plan, find someone who has the right education, skillset, and experience to do the work with you. The CERTIFIED FINANCIAL PLANNER™ designation is a good starting place. If your advisor is a CFP® you know that they have studied for and passed a rigorous curriculum that looks at every aspect of a client’s financial picture. At our firm we have a team of CFP® professionals who work with clients on financial plans.

Once you start researching financial advisors, if you are doing your homework, you should be asking them how they are compensated. You may have heard of “fee-based” versus “fee-only.” These are two different concepts. Fee-only advisors act as a fiduciaries, which means that they are obligated to put their clients’ interests first, and it also means that they are paid directly by the clients for services provided. Fee-only clients may not receive compensation from other parties – for example, they can’t receive commissions from mutual fund companies, or from insurance companies. All they can do is receive compensation directly from the clients.

The difference between fee-only and fee-based is this word: fiduciary, which we just described as putting the client’s interest first. There is another keyword you should know and that is “suitable.” A financial advisor may, in fact, sell a product that is ‘suitable’ for the client, but not necessarily in the client’s best interest. A fee-based advisor may indeed be compensated by an insurance company or mutual fund, provided they sell suitable products. A fee-based advisor is not a fiduciary.

At Beck Bode, we are a fee-only firm. I will tell you, however, that it took a journey to get to this point. We started as ‘fee-based’ advisors where we were paid a portion of our fees by our clients but at that point we also received commissions. Then, we educated ourselves on understanding what that really meant. The implications were huge! Even though we were being ethical, we truly wanted to be on the same side of the desk as our clients. We wanted to ensure that every decision was in our client’s best interest, no matter what. If we were going to do our job well, then what is most important to the client has to be most important to us, too. It was a learning process for us, but it was well worth it, and it shows in the quality of the relationships we have with our clients.

James Bode is a Managing Partner at Beck Bode, a deliberately different wealth management firm with a unique view on investing, business and life.

Ready to make your money work for you? Don't wait - reach out today for a complimentary “Discovery” call for us to learn about your financial goals and see how our services can help you!

CONTACT

858 Washington St. Suite 100 Dedham, MA 02026

invest@beckbode.com

(617) 209–2224

(617) 249–0298

Copyright © 2026 Beck Bode, LLC