What two NBA stars and a betting scandal can teach us about humility, randomness, and the only edge that actually lasts in Investing.

Picture this. Two former Boston Celtics — names once cheered in the Garden — being escorted by federal agents, faces hidden behind hoodies, the flash of cameras bouncing off black SUVs. Chauncey Billups, an NBA champion turned head coach of the Portland Trail Blazers, and Terry Rozier, now with the Miami Heat, both arrested in a sweeping FBI investigation that pulled back the curtain on a sports-betting scandal that reads like a script too absurd even for Netflix.

The charges? Using insider information to place bets — information about player injuries, minutes, and strategy — in what the feds allege was a multimillion-dollar gambling ring. And if that wasn’t enough, they’re connected to an illegal high-stakes poker network involving members of organized crime.

You almost can’t believe it. But then again, maybe you can.

Because we’ve all watched the slow normalization of gambling.

You can’t get through a single quarter of an NBA game without being told, “Bet on the next rebound,” by DraftKings, FanDuel, BetMGM, and whoever else is lined up at the trough.

Kevin Hart’s doing commercials. Kevin Garnett’s doing them too. Every timeout feels like a new invitation to wager — a tap on the shoulder whispering, “C’mon, you can beat the odds.”

But you can’t. And that’s the point.

The Vice We Dressed in a Suit

Gambling has always been around. It’s one of humanity’s oldest vices — the illusion that chaos can be controlled. But something about this era feels different. It’s no longer in the smoky backroom; it’s in HD, in our living rooms, and it’s been dressed up as “fan engagement.”

Let’s be honest: what we’ve done as a culture is take a vice and rebrand it as participation. And the danger of that shift isn’t just about people losing money — it’s about what it does to the psyche. It convinces people that they can control randomness. That if they just pay attention, or feel the rhythm of the game, they can tilt the odds in their favor.

That’s the arrogance that got Billups and Rozier arrested. And it’s the same arrogance that ruins investors every single day.

The Illusion of Control

What’s fascinating, and honestly tragic, about this scandal is not that these men made bad choices. It’s that they believed they had certainty. They thought they could outsmart the randomness of the game. They thought their inside knowledge gave them control over the uncontrollable.

That’s the arrogance of the gambler. It’s also the arrogance of the investor who thinks he can pick the next sector winner, time the next rally, or find the perfect hedge that’ll “protect” him from volatility.

It’s the same disease.

Because the moment you start believing you can predict what’s inherently unpredictable, you’ve already lost.

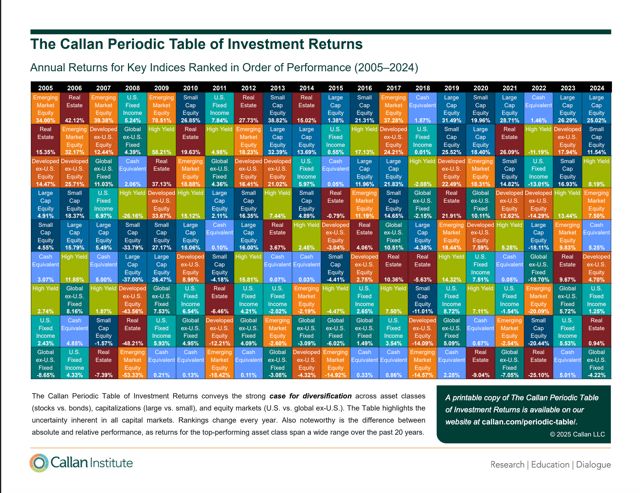

If you don’t believe me, go look at the Callan Periodic Table of Investment Returns — one of the great humbling pieces of financial literature ever printed.

The Table That Tells the Truth

Every advisor in my generation grew up with that chart. It’s this mosaic of color-coded boxes showing how different asset classes performed each year — large cap, small cap, emerging markets, real estate, commodities, bonds.

Every year, it’s different. One year, small caps are the hero. The next, they’re the villain. Emerging markets soar, then crash. REITs have their moment, then they’re the anchor dragging the whole thing down.

It’s chaos. And that chaos is the point.

What the table tells you, if you’re willing to look closely, is that we don’t know. We will never know. There’s no pattern. No secret. No consistency.

Warren Buffett once called diversification a “confession of ignorance” — meaning, you diversify when you don’t know what you’re doing. But I’ve always seen it the other way.

Diversification is not a confession of ignorance. It’s a profession of humility.

It’s saying: I’m intelligent enough to know what I don’t know.

The Discipline of Humility

I remember my mentor and author of Dancing with the Analysts, David Mallach, saying something that stuck with me forever:

“I’ve seen one-star mutual funds turn into five-star funds, and I’ve seen five-star funds fall all the way back to one.”

Reversion to the mean is real. It’s gravity.

And if you accept that truth — if you respect the randomness of performance — then you stop chasing winners. You stop pretending you know which sector or stock is going to light it up next.

You start investing with humility.

Now, humility doesn’t mean weakness. In fact, it’s one of the most aggressive postures you can take. Because when you embrace humility, you stop gambling. You stop chasing. You stop trying to control the uncontrollable.

Humility is the hard discipline of saying: I don’t know, and that’s exactly why I’m going to build a portfolio that doesn’t rely on me being right.

The Seduction of Over-Diversification

Now, let’s be clear — humility doesn’t mean holding 150 different tickers just to say you’re diversified. That’s not humility; that’s fear.

Most investors, and most advisors if we’re being brutally honest, use diversification as a security blanket — a way to “protect” clients from the volatility of the stock market.

And I’ve always asked: protect them from what, exactly? From the risk of temporary decline? The same kind that happens every few years, like clockwork?

Why would you protect someone from a risk that doesn’t exist in the long term?

That’s not diversification; that’s dilution. And the cost of that dilution is enormous. Every layer of unnecessary diversification — the private equity sleeve, the commodities sleeve, the “inflation hedge” sleeve — chips away at your long-term return.

You mute volatility, sure. But you also mute growth. And if you mute growth, you threaten your required rate of return — the one number that actually matters.

So you end up with a portfolio that feels safer, looks safer, but mathematically guarantees mediocrity.

And mediocrity is the investor’s version of indictment.

Proper Diversification: The Sweet Spot of Humility

Here’s the proper definition — our definition — of diversification:

Diversify away as much of the diversifiable risk as possible, but no more.

That’s it. You can do that with 10 stocks. Maybe 30. You don’t need 300.

If the long-term average rate of return of the S&P 500 is roughly 10%, why would anyone deliberately build a portfolio that guarantees less — without any evidence it improves the outcome?

That’s the arrogance of complexity.

Humility says: Simple is hard enough.

The Discipline of Rebalancing

Every few years, the sectors reshuffle. Leaders become laggards, laggards become leaders. We don’t know when, or how. But we do know this: by maintaining balance and rebalancing when the scales tip, we’re forced to act against instinct.

Rebalancing requires humility and courage.

It makes us sell what’s working and buy what’s not — the opposite of human nature.

That act doesn’t just rebalance a portfolio.

It rebalances behavior.

When Arrogance Takes Over

Now, back to our NBA friends.

If you strip away the headlines, what you’re really seeing in that scandal is the total collapse of humility. These were men who had made it to the top of the world — wealth, fame, respect — and it still wasn’t enough. They thought they could beat the system. They thought the rules didn’t apply to them.

That’s arrogance.

And it’s the same arrogance that makes investors chase “the next big thing.” Whether it’s crypto, meme stocks, AI plays, or private real estate funds, it’s all the same instinct: I’ve got an edge.

Humility says: There are no edges — only odds. And the only way to win long term is to play the odds that compound, not the odds that collapse.

The Real Lesson

The riskiest moment in any pursuit — basketball, business, investing — is when you feel like you’re right. That’s when you stop listening. That’s when you double down. That’s when the market, or life, humbles you.

Diversification, properly practiced, is how we preempt that humility. It’s how we build systems that prevent us from becoming the next cautionary tale.

It’s not passive. It’s not timid. It’s the conscious choice to respect randomness while still showing up with conviction.

That’s how you survive markets. That’s how you win championships that actually last.

The Final Word

Good markets teach bad lessons. That’s true for investors, and it’s true for athletes.

And as this bull market rolls on — as portfolios climb, as the economy steadies — don’t get seduced by the illusion of control. Stay humble enough to admit you don’t know. Stay disciplined enough to rebalance anyway.

Because humility isn’t soft. It’s armor. And in a world obsessed with certainty — whether it’s Wall Street or the NBA — humility is the only edge left.

So, if not US to preach it to investors…then who?

And if not now, then when?

We do it…we do it now. And we do it relentlessly.

-----------

Ben Beck is Managing Partner & Chief Investment Officer at Beck Bode, a deliberately different wealth management firm with a unique view on investing, business and life.

Benjamin Beck, CFP®

Benjamin Beck, CFP®